Language

English

Tuition fees*

Nacional: 1500€

International: 5000€

CPLP International: 2750€

Schedule

Mainly daytime programme

Duration

2 years

Applications

2nd call: 19/08/2025 until 25/08/2025 (only if there are leftover vacancies)

Beginning of the programme

September

* Tuition fees for the academic year 2025/26 (Full Tuition Fee). More information here.

Best masters programme in Portugal for return on academic investment *

* Financial Times Masters in Finance 2025 Ranking

Director of the Master in Finance

Masters > Master in Finance

1st Year

| 1st Semester | |

|---|---|

| Name | Credits |

| Theoretical Foundations of Finance | 6 |

| Markets and Financial Investments | 6 |

| Econometric Methods | 6 |

| Corporate Finance | 3 |

| Business Valuation | 3 |

| Seminars I | 3 |

| Project I | 3 |

| 2nd Semester | |

|---|---|

| Name | Credits |

| Modelling and Data Analysis I | 3 |

| Ethics and Corporate Governance | 3 |

| Mergers, Acquisitions and Restructuring | 3 |

| Derivatives | 3 |

| Fixed Income Securities | 3 |

| Seminars II | 3 |

| Project II | 3 |

| Optional course units to be chosen from a cast fixed annually by the Scientific Council, such as:

Real Options |

9 |

2nd Year

| 1st Semester | |

|---|---|

| Name | Credits |

| Research Methodology | 3 |

| Risk Management | 3 |

| Modelling and Data Analysis II | 6 |

| International Finance | 3 |

| Seminars III | 3 |

| Project III | 3 |

| Optional course units to be chosen from a cast fixed annually by the Scientific Council | 9 |

| 2nd Semester | |

|---|---|

| Name | Credits |

| Dissertation/Work Project/Internship | 30 |

Masters > Master in Finance

Target group

The candidates should have a bachelor´s degree in Management, Economics or in a related field and be fluent in English. The programme is suitable for those wishing to acquire the skills necessary to develop a career in Finance. It also suits those who require adequate scientific training in order to pursue more advanced graduate studies in Finance. Professional experience is not a prerequisite. The candidates should be available for a full-time programme.

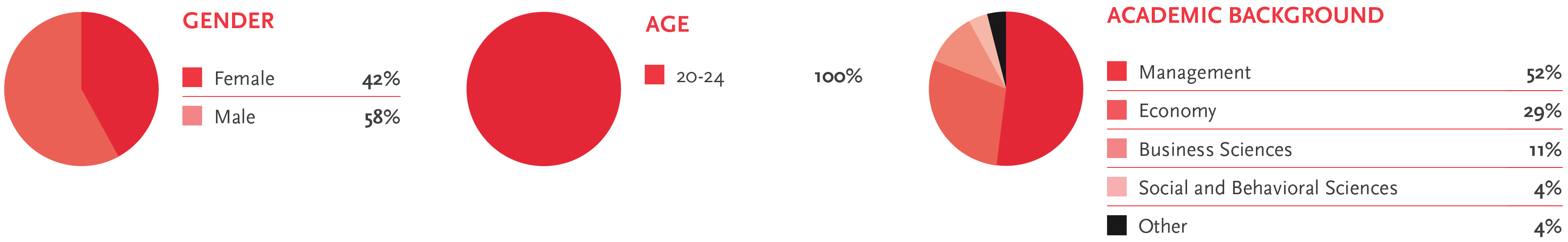

Student profile

Data related to students enrolled in the 2024/2025 academic year.

Masters > Master in Finance

Career Opportunities

The Master in Finance provides students with important skills to pursue a successful career in finance, both at a professional and academic level. In particular, MIF students are prepared to work in:

- Investment banking

- Commercial banking

- Fintech

- Insurance companies

- Manufacturing organizations, in the area of financial management

- Etc.

Masters > Master in Finance

Rankings

In 2025, FEP’s Master in Finance was listed in the prestigious ranking “Masters in Finance 2025”, of the Financial Times (FT). The programme is ranked 41st worldwide in this exclusive ranking for Finance programmes, one of the most influential among Economics and Management schools globally. At the national level, the Master’s ranks 1st in terms of return on academic investment and 2nd for career progression, demonstrating the positive impact of the programme on graduates’ professional advancement.

The Master in Finance is in the 18th place in the Eduniversal Masters Ranking 2024 of the best programmes in Corporate Finance in Western Europe. The Master is also ranked 111-120th in the QS Business Masters Rankings 2024, which lists the best programmes in finance in the world.

The Master in Finance has been accepted into the CFA University Affiliation Program. This status is granted to institutions whose degree programme(s) incorporate at least 70% of the CFA Programme Candidate Body of Knowledge (CBOK), recognizing programmes that provide students with a solid grounding in the CBOK and positions them well to sit for the CFA exams. The Master in Finance is entitled to award three CFA Programme Awareness Scholarships to students each fiscal year, as detailed in the Awareness Scholarship Official Rules of the CFA Institute.

Double Degrees

Upon selection process, the students from the Master in Finance have the possibility of doing a double degree in two renowned schools – Kozminski University (Poland) and Prague University of Economics and Business (Czech Republic).

Masters > Master in Finance

Testimonials

“The Master in Finance at FEP is an internationally recognized programme for its innovative approach to the teaching of Finance. The programme is part of a broader academic ecosystem (UPorto) which is truly stimulating. The faculty of top-notch quality and the talented pool of students make the MiF experience a continuous though-provoking challenge. The master’s structure is flexible, allowing students to fine-tune their pathway according to their own preferences. Thus, the MiF is a programme suited both to students with the goal of following a professional career in the world of financial markets as well as to those who wish to follow an academic route. At FEP, you will find a unique programme that fully prepares students to become leaders of exceptional quality”

“Thanks to the Master in Finance at FEP I had my biggest learning curve – not only studying the theory, we were forced to put this into practice. All the assignments we had to do, it comes out, are done in the real world in most cases. Even though the professors are top of their field, they are approachable and even more – very motivating in the sense of how dedicatedly giving their lectures. I am grateful for this opportunity. It gave me the confidence to start my career in a way to speak up for new ideas and taking opportunities to learn every day as much as possible. Undoubtedly, I would not be here where I am right now without the degree and most importantly, not heading to achieve bigger goals.”